Many of the poorest families in Malawi are going hungry for several months of the year. The poorest people live in rural areas and women are more likely to be poor than men.

Women in these communities are often financially excluded and do not have the same access to education and training to help them to build businesses. Women also do 75% of unpaid work in the household which means they have less time to dedicate to their businesses to earn an income to support their family.

The United Nations Sustainable Development Goals are the blueprint for achieving a better and more sustainable future for all. This project contributes directly to the goals No Poverty, Zero Hunger and Gender Equality. The impact of our work also addresses the goals on Quality Education, Decent Work and Economic Growth, Climate Action, Life on Land and Partnerships for the Goals.

How MicroLoan’s project addresses this problem:

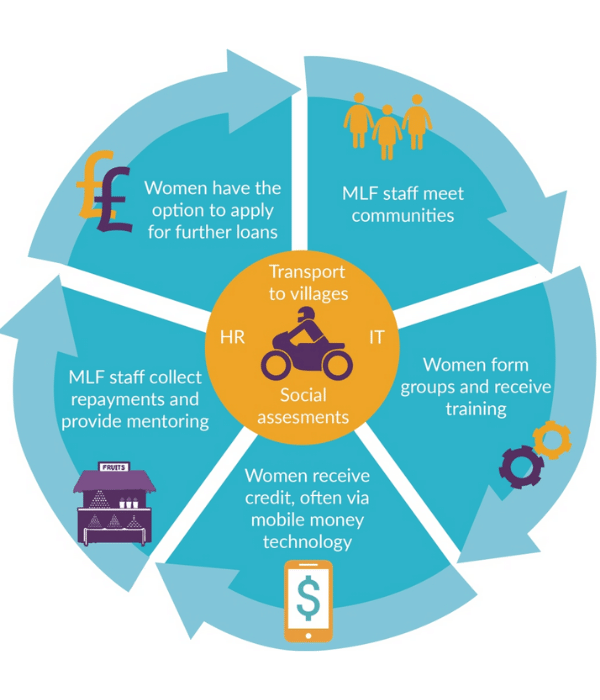

MicroLoan Foundation is providing women facing poverty with business skills and financial literacy training and small loans to invest in businesses. As they build a successful, profitable business they generate a steady income to provide for their families.

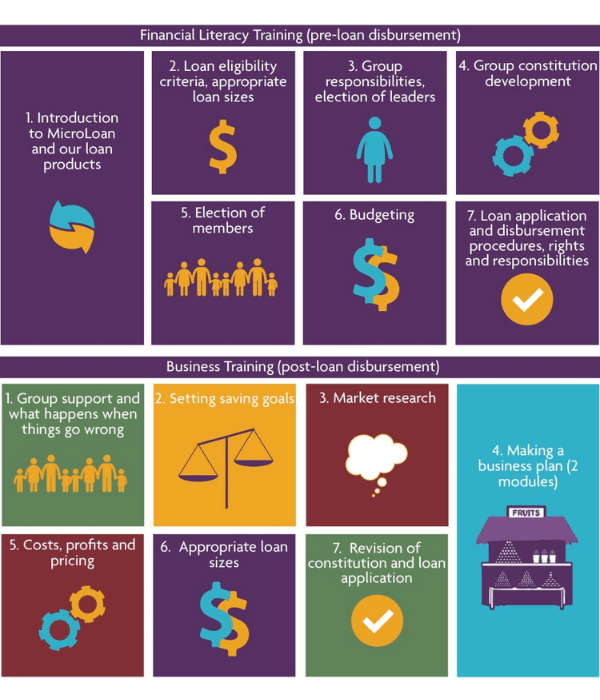

The training is essential to set women up for success. It focuses on business and financial literacy skills such as market research, reinvesting profits, budgeting and making savings. The training is taught through song, dance and role play so that women who are unable to read and write are included.

The training is delivered in person by our well-trained Loan & Training Officers (LTOs), local individuals who travel to rural communities by motorbike. The training programme sets women entrepreneurs up for success, so that they grow their businesses, and grow their profits.

25 women entrepreneurs in Salima, 5 groups of 5 women, will take part in financial literacy training, business skills training, and get access to small, affordable loans.

As they succeed in generating a steady income, they can provide for their families. The women have on average of four children each and as household income increases, the women can afford to feed their families a nutritious diet, pay for healthcare and send their children to school.

When one woman prospers, a whole community can be positively impacted. MicroLoan’s data also shows that as women grow their businesses, they create employment opportunities for family members and others in the community.

On average, the percentage of our clients with one or more paid employees (not including family) in 2021 was 8%, and 51% of our clients have increased their business profit after receiving our services.

More Information

Poverty in Malawi

Poverty in Malawi is overwhelmingly rural and disproportionately female. Out of Malawi’s population of 19.1 million people, 83% live in rural areas, where poverty is more severe. The country is subject to regular floods and droughts, exacerbated by the effects of climate change, which greatly affect the rural poor. As an agrarian economy, an estimated 90% of our beneficiaries engage in subsistence farming, making them particularly vulnerable to food insecurity. Furthermore, a lack of employment and livelihood opportunities means that moving out of poverty poses a significant challenge.

Poor women in these areas are acutely affected. Disadvantaged by cultural and traditional norms, they have limited access to education and financial services. They also bear the brunt of caregiving responsibilities and have little opportunity to secure reliable and regular income, making rural women the most underserved section of Malawian society.

MicroLoan’s social microfinance model has been carefully developed over 20 years to target this portion of the population. In 2021 we supported 49,512 in Malawi and 29,276 women had a business loan with us at year-end.

Visit Website: MicroLoan Foundation